Introduction

In the construction industry, surety bonds play a crucial role in ensuring that contractors fulfill their obligations. However, an aspect that often gets overlooked is the cost associated with these bonds. license and permit bonds FAQ Understanding the intricacies of surety bond cost is essential for contractors who wish to maintain their financial health while fulfilling project requirements effectively. This article will delve deep into why understanding surety bond costs is essential for contractors, unraveling various factors influencing those costs and providing insights into how they can manage them more effectively.

What are Surety Bonds?

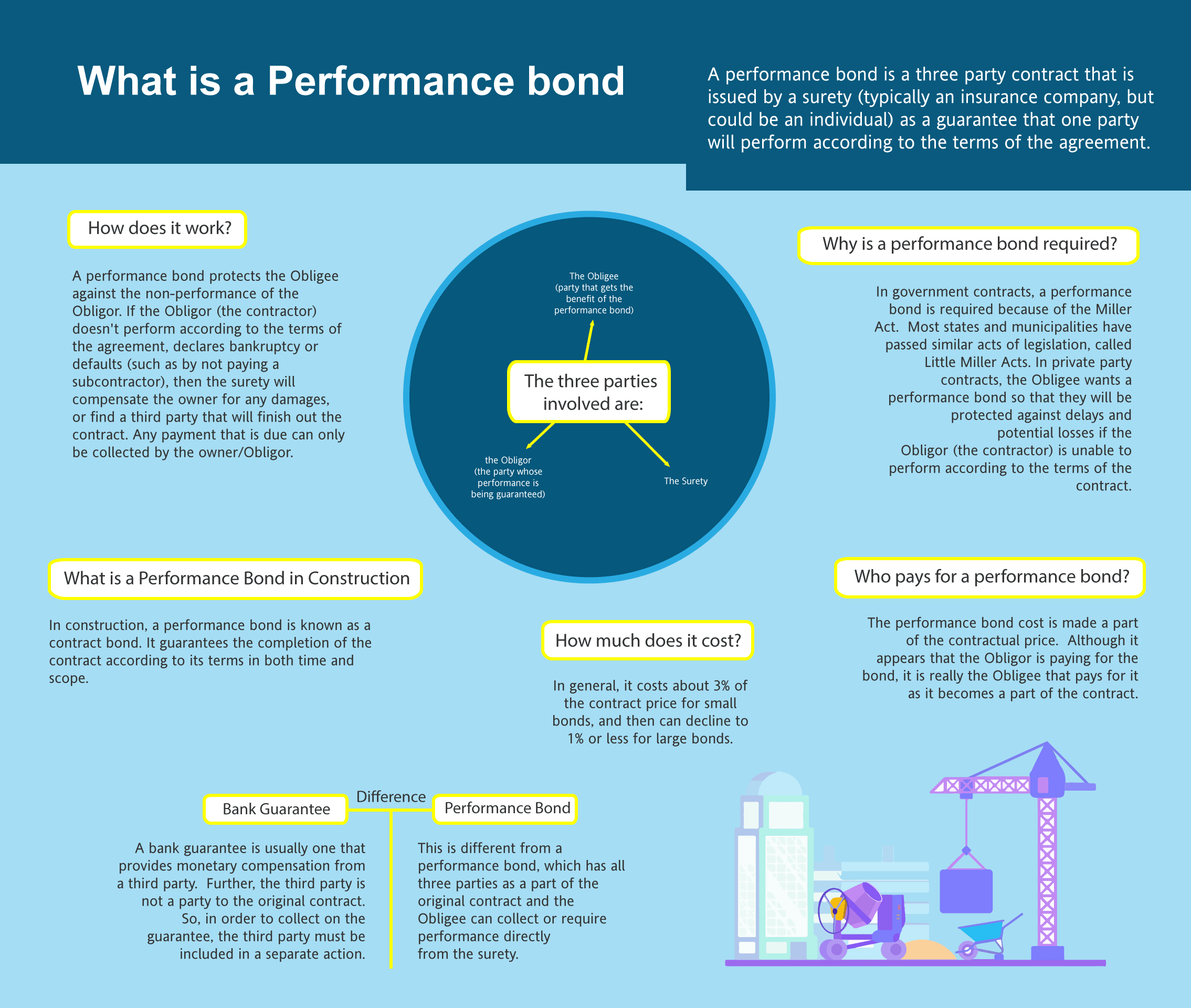

Definition of Surety Bonds

A surety bond is a legally binding contract between three parties: the principal (the contractor), the obligee (the project owner), and the surety (the bonding company). The purpose of this bond is to guarantee that the principal will complete the project according to stipulated terms and conditions.

Types of Surety Bonds

Contract Bonds: These are used in construction projects, ensuring that contractors adhere to contractual obligations. Commercial Bonds: These include licenses and permits necessary for businesses. Court Bonds: Often required in legal proceedings to ensure compliance with court orders.Importance of Surety Bonds in Construction

Surety bonds serve as a safety net for project owners, ensuring financial protection if a contractor fails to deliver on their promises. For contractors, having a surety bond can enhance credibility and increase their chances of securing contracts.

Why Understanding Surety Bond Costs is Essential for Contractors

Understanding surety bond costs allows contractors to budget accurately, assess risks, and make informed decisions about securing projects. It also helps them understand what affects these costs, leading to more effective negotiations with bonding companies.

Factors Influencing Surety Bond Costs

Credit History

Your credit score plays a significant role in determining your surety bond cost. A strong credit history often results in lower premiums.

Project Size and Scope

The size and complexity of the project influence the bond amount required. Larger projects usually require higher bonds, thus increasing costs.

Industry Experience

Contractors with extensive experience may find it easier to secure lower rates due to established reputations.

Financial Stability

Bonding companies assess your financial stability through various metrics such as net worth and liquidity ratios, which can significantly impact your premium rates.

How Surety Bond Costs Are Calculated

Premium Rates Explained

Typically expressed as a percentage of the total bond amount, premium rates vary based on several risk factors associated with the contractor’s profile.

Example Calculation Breakdown

| Factor | Impact on Cost | |-----------------------------|----------------------------------| | Credit Score | Higher score equals lower rates | | Project Amount | Larger amounts mean higher costs | | Industry Risk Level | High-risk industries face higher premiums |

Common Misconceptions About Surety Bond Costs

Myth 1: All Contractors Pay the Same Premiums

Contrary to popular belief, not all contractors face identical premium rates; costs vary widely based on several individual factors.

Myth 2: Paying More Guarantees Better Coverage

While higher payments may offer better coverage options, it's crucial to assess what you truly need rather than opting for unnecessary extras.

Strategies for Reducing Surety Bond Costs

Improve Your Credit Profile

Regularly check your credit report for inaccuracies and take steps to improve your score by paying off debts promptly.

Choose Projects Wisely

Select projects that align well with your experience level and financial capacity; this minimizes risks associated with new ventures.

Build Relationships with Bonding Agents

Establishing strong relationships can lead to better negotiation outcomes regarding premiums and terms.

Common Questions About Surety Bond Costs

1. What Is the Average Cost of a Surety Bond?

The average cost typically ranges from 0.5% to 3% of the total bond amount but can vary significantly based on individual circumstances.

2. How Long Does It Take To Get Bonded?

The bonding process generally takes anywhere from one day up to two weeks, depending on how quickly you can provide necessary documentation!

3. Can I Get a Refund if My Project Gets Canceled?

Most bonding companies do not issue refunds once you’ve secured a bond; however, some might have policies allowing partial refunds under specific conditions.

4. What Happens If I Fail To Complete A Project?

If you fail to fulfill your contractual obligations, claims may be filed against your surety bond which could result in financial repercussions or increased future bonding costs!

5. Are There Alternatives To Surety Bonds?

Yes! Alternatives like letters of credit or cash deposits exist but often come with different risks and implications than traditional sureties!

6. Do I Need Multiple Bonds For Different Projects?

Yes! Each project typically requires its own individual bond unless specified otherwise by the obligee!

Conclusion

Understanding surety bond costs is indispensable for contractors navigating today’s competitive construction landscape. By grasping how these costs are determined and exploring strategies for reducing them, contractors can position themselves favorably when bidding on projects while safeguarding their financial interests. Remember that being proactive about understanding your unique situation can lead not only to license and permit bonds savings but also greater opportunities in securing lucrative contracts!

By prioritizing knowledge around surety bond cost, contractors empower themselves with essential tools needed for success—ensuring they remain competitive while delivering quality work consistently in an ever-evolving market landscape!