Introduction

In today's competitive construction landscape, contractors are constantly seeking ways to enhance their business operations and expand their market reach. One effective approach is diversifying through bonding—specifically, contractor bond insurance. This strategy not only protects your business but also increases your credibility with clients and stakeholders. In this comprehensive guide, we will delve into the smart strategies for diversifying your contracting business using bonds. From understanding different types of bonds to exploring how they can impact your bottom line, this article aims to equip you with the knowledge needed to thrive in the contracting world.

Understanding Contractor Bond Insurance

What Is Contractor Bond Insurance?

Contractor bond insurance serves as a safety net for both contractors and their clients. It guarantees that a contractor will fulfill their obligations according to the contract terms, providing financial security in case of non-compliance or default. But what does this mean for you? Essentially, when you obtain a contractor bond, you're demonstrating that you have the necessary resources and commitment to complete a project satisfactorily.

Types of Contractor Bonds

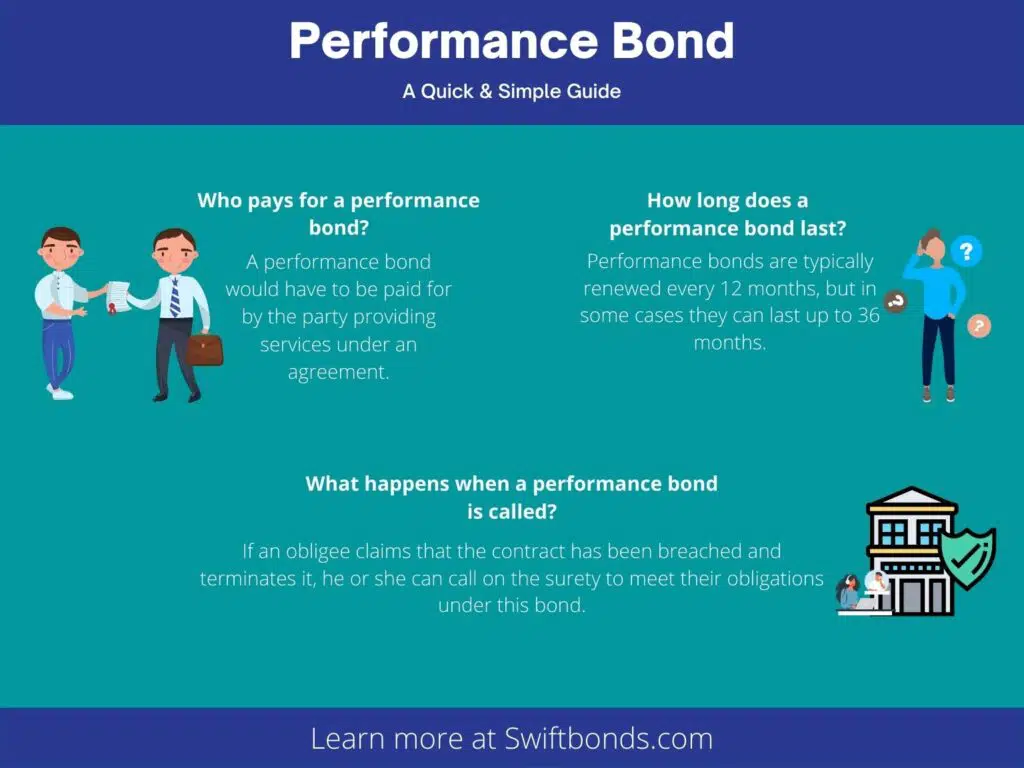

Bid Bonds: These are required during the bidding process and ensure that you will take on the project if selected. Performance Bonds: These guarantee that you'll complete the project according to the contract specifications. Payment Bonds: These protect subcontractors and suppliers by ensuring they get paid, even if the primary contractor defaults. License Bonds: Certain states require these bonds as a condition for obtaining necessary licenses.Why Are Contractor Bonds Important?

The importance of contractor bonds cannot be overstated. They provide reassurance to clients that you're financially stable and committed to fulfilling your contractual obligations. In many cases, having these bonds can be a deciding factor in securing contracts.

Smart Strategies for Diversifying Your Contracting Business with Bonds

Assess Your Current Bonding Needs

Before delving into diversification strategies, it’s essential to assess your current bonding needs thoroughly. Are you meeting regulatory requirements? Are there gaps in your coverage? Understanding where you stand enables targeted growth.

Explore New Markets

Diversity often comes from branching out into new markets. Whether it’s entering government contracting or expanding into residential or commercial projects, consider how bonding can facilitate entry into new sectors.

Identifying Opportunities

- Research local government projects requiring contractors with specific bonds. Attend industry trade shows focusing on areas you'd like to explore.

Strengthen Your Financial Foundation

A robust financial foundation is crucial when pursuing additional bonding opportunities. Lenders often look at your license and permit bonds financial health before issuing bonds.

Implementing Financial Strategies

Improve Cash Flow Management: Ensure timely invoicing and manage expenses effectively. Maintain an Emergency Fund: This can help cover unexpected costs that may arise during projects. Enhance Creditworthiness: A strong credit score makes it easier to secure favorable bonding options.Partnering with Bonding Agents

Working alongside experienced bonding agents can help navigate complex regulations and identify suitable bonding options tailored to your contracting needs.

Benefits of Collaboration

- Expert Guidance: Bonding agents understand the nuances of different types of bonds. Access to Insurer Networks: They often have established relationships with various insurance companies.

The Role of Technology in Bond Management

Utilizing Software Solutions

Technology has revolutionized how businesses manage contracts and bonds. Software solutions specifically designed for bond management streamline processes, improve accuracy, and save time.

Key Features of Bond Management Software

- Automated Alerts: Stay informed about renewal dates or upcoming deadlines. Document Management: Keep all bond-related documents organized and easily accessible. Real-time Reporting: Gain insights into your current bond status at any time.

Training Staff on Technology Utilization

Investing time in training staff on new technology ensures everyone understands how to use these tools effectively, which ultimately enhances productivity across your organization.

Networking Within the Industry

Building Relationships with Other Contractors

Networking plays an invaluable role in diversifying your contracting business through bonds. Engaging with fellow contractors can lead to collaborations on larger projects requiring multiple types of bonds.

How Networking Can Help You Grow

- Share Knowledge: Learn from others' experiences regarding acquiring contractor bond insurance. Opportunities for Joint Ventures: Working together increases access to larger contracts while sharing bonding responsibilities.

Joining Professional Associations

Becoming part of industry associations allows you access to valuable resources, including networking opportunities and educational materials related to contractor bonding.

Marketing Your Bonded Status

Leveraging Social Media Platforms

In today’s digital age, social media is an excellent platform for showcasing your bonded status as a contractor. Highlighting this aspect can attract potential clients who prioritize working with insured professionals.

Content Ideas

what are license and permit bonds Success Stories Showcasing Completed Projects Testimonials from Satisfied Clients Informational Posts About Different Types of BondsCreating Informative Website Content

Your website should serve as a hub for information regarding contractor bond insurance and its benefits for potential clients looking for reliable contractors like yourself.

SEO Considerations

Utilize relevant keywords throughout your site content (like “contractor bond insurance”) while ensuring it flows naturally within context—this boosts search engine visibility!

Measuring Success After Diversification

Defining Key Performance Indicators (KPIs)

After implementing diversification strategies involving contractor bond insurance, it's critical to measure success through KPIs such as:

Regular Review Processes

Establish routine evaluations (quarterly or biannually) assessing whether diversification efforts yield desired results—make adjustments based on findings!

FAQs about Smart Strategies for Diversifying Your Contracting Business with Bonds

What is contractor bond insurance?- Contractor bond insurance guarantees compliance with contractual obligations, providing security for both contractors and clients against default or non-compliance issues.

- The type of bond required typically depends on project specifics; consulting with an experienced bonding agent is advisable for tailored recommendations based on individual circumstances.

- While possible through other methods like marketing or expanding service offerings alone—having appropriate bonds significantly enhances credibility among prospective clients!

- Challenges include poor credit history affecting eligibility rates/terms offered & insufficient financial documentation leading insurers unable assess risk appropriately—both solvable through proactive measures beforehand!

5.Benefits associated w/ having multiple types-of-bonds?

- Multiplying different forms-of-bond(s) helps build trust among stakeholders while facilitating access larger contracts because most projects require performance/payment assurances included therein!

6.How often should I reassess my current-bond-needs?

- Regular assessments (at least annually) are recommended considering fluctuations within industry standards/business growth & changes occurring legislation surrounding regulations/bonds governing practices involved hereafter!

Conclusion

Diversifying your contracting business through smart strategies involving contractor bond insurance is not just about protecting yourself; it's also about positioning yourself as a credible player within the market landscape! By understanding various types-of-bonds available enhancing connections made across industry networks leveraging technology effectively advertising bonded status—you’ll undoubtedly pave pathways leading toward sustainable growth! Remember always keep learning adapting along way; success stems from continual improvement driven effort!